On March 24, 1986, Time Magazine’s cover article was titled “Sorry, America, Your Insurance Has Been Cancelled.” The article referenced the collapse of the U.S. commercial liability insurance market – principally associated with run-away inflation and the bursting of a historically high interest rate bubble.

Today, the U.S. insurance market finds itself again in distress. In some ways the market dynamics appear similar at first glance to the 1980’s (e.g. inflation); however, these days there are altogether new headwinds affecting the U.S. insurance market. The consistent severity of insured catastrophe losses, combined with tighter insurance regulation limiting insurance companies’ ability to freely manage their rates and rules, has expanded the insurance crisis beyond commercial liability to now include the individual property market – homeowners.

This update will address the main pressures facing the U.S. property and casualty insurance market and more specifically, how these pressures are affecting our individual family and family office clients.

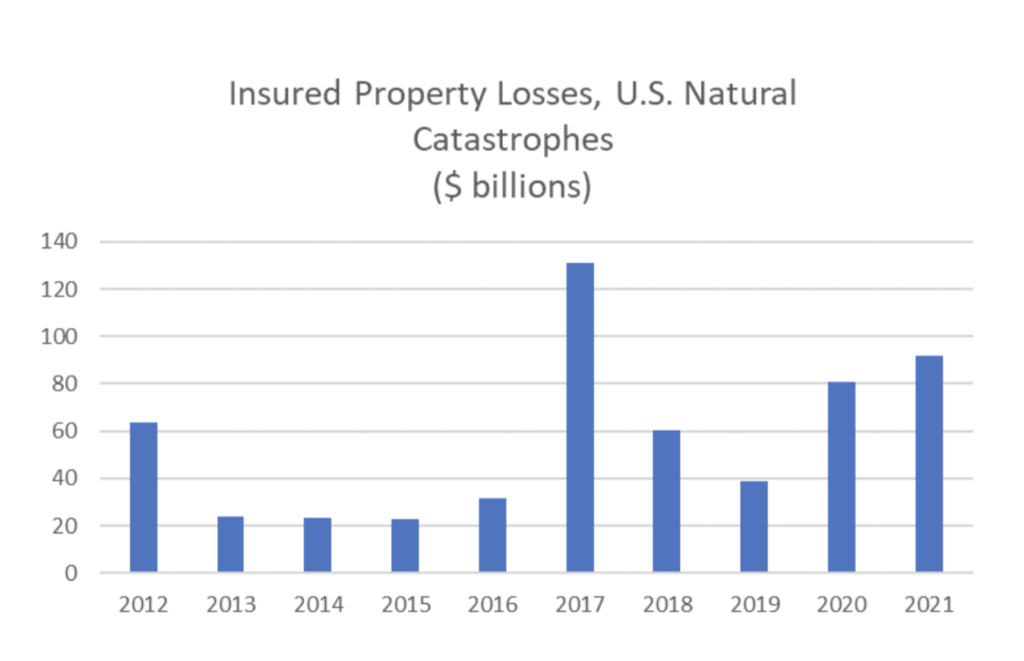

Catastrophe losses, defined as an event causing significant insured property loss that impacts a large number of policyholders and insurance companies, have increased in both frequency and severity over the past 5 years. Common causes of catastrophe losses have expanded beyond gulf/mid-Atlantic hurricanes and California earthquakes to now consistently include wildfires and strong convective southeastern and midwestern U.S. storms. This graph below shows the total insured property losses associated with natural catastrophe losses over the past 10 years. It is notable that in the 5 years between 2012 – 2016, the average annual U.S. insured total catastrophe loss amount was roughly $30B/year. In the 5 years between 2017 – 2021, this annual average has increased exponentially to over $80B/year.

Increased western wildfire and storm related wind/hail events, combined with increased population density in locations where these types of events tend to occur, are two of the principal drivers behind the severity increase over the past 5 years.

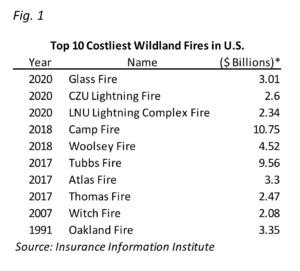

Due mostly to dry brush conditions associated with the prolonged drought currently affecting the Western U.S. states, property damage associated with Western U.S. wildland fires have shown an alarming trend line over the past 5 years. Of the top 10 costliest wildland fires in the U.S, 8 have occurred since 2017 (Fig.1). The other wildfires to make the top 10 list occurred in 2007 and 1991.

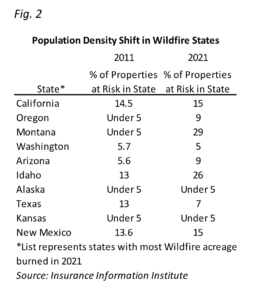

Additionally, most U.S. states with the greatest risk of wildland fires have also seen population density increases in areas specifically defined as being exposed to wildland fires. States such as Montana and Idaho have seen such population growth that over a quarter of the properties in the state are exposed to a potential wildfire catastrophe (Fig. 2).

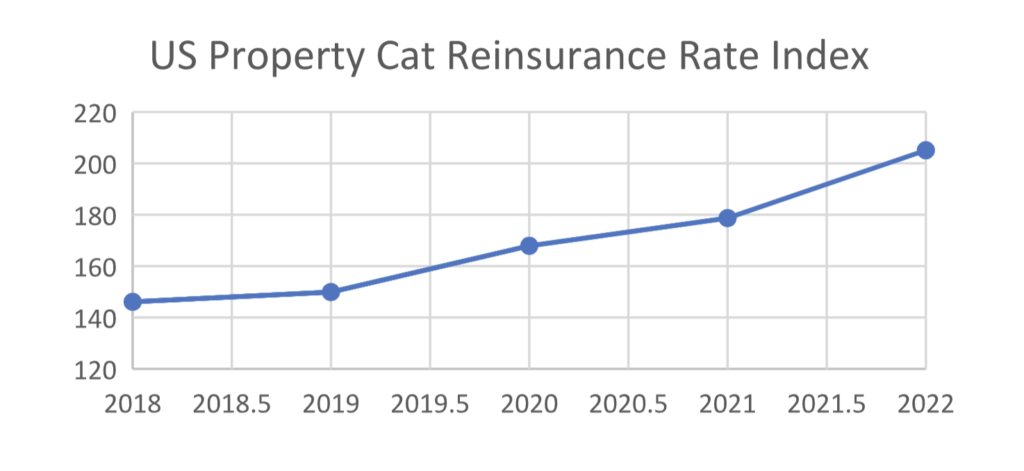

Inflation associated with property construction costs (materials and labor) has been widely reported for the past several years. These inflated building costs drive higher reconstruction claim expenses for insurance companies, but this only tells half of the inflation story. Driven by the increase in U.S. catastrophe losses over the past 5 years, the cost of reinsurance, insurance purchased by all insurance companies in order to expand their ability to assume risk, is increasing significantly. Since 2018, the cost of U.S. property catastrophe reinsurance has increased over 40%, which in turn adds higher policy expense costs to insurance companies already digesting higher catastrophe underwriting losses.

Additionally, in many states, insurance companies are limited in their ability to pass along these higher loss and reinsurance costs to the consumer due to tight insurance regulation. California’s Proposition 103, passed in 1988, makes it very difficult for homeowner insurance companies doing business in California to raise premiums in order to offset higher reinsurance expenses and claim losses. As a result, in 2022, most California property insurance companies are no longer writing new business and some are actively non-renewing existing customers in wildfire exposed areas. California homeowners are increasingly being left with fewer homeowner insurance options and often have to settle for more expensive, less-regulated insurance policies. Similar to California, in 2023, we anticipate other Western U.S. states to become much more difficult with respect to affordable and available homeowner insurance.

Pricing pressure and limited product availability will continue to plague high value property insurance consumers. Pockets of extreme distress developing in states like California and other western states, severely restricting the availability of affordable property insurance, will continue to expand in 2023, and likely 2024. We are encouraging our clients making property purchases in wildfire exposed western states to not delay investigating their insurance options, as homeowner insurance in these areas is becoming a much more material consideration.